S corp payroll tax calculator

How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

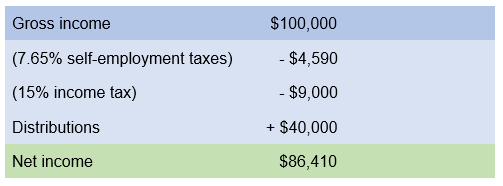

Tax Savings Calculator Page Forming an S-Corporation instead of a Sole Proprietorship You may be able to reduce self-employmentpayroll taxes by being taxed as an S-Corporation.

. S-Corp VS Sole Prop Calculator. Ad Get Ahead in 2022 With The Right Payroll Service. 1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state.

Get an accurate picture of the employees gross pay. 2020 Federal income tax withholding calculation. 2 Prepare your FICA taxes Medicare and Social Security monthly or semi.

From the authors of Limited Liability Companies for Dummies. Get Started With ADP Payroll. Subtract 12900 for Married otherwise.

You also need to pay federal. For example if an employee earns 1500. You the employee also need to pay a 765 payroll tax as an employee.

Make Your Payroll Effortless So You Can Save Time Money. Ad Compare This Years Top 5 Free Payroll Software. Put Your Payroll Process on Autopilot.

This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through. Our Expertise Helps You Make a Difference. Focus on Your Business.

Calculate payroll and taxes Once theyve determined their salary S corporation owners divide the annual figure by the number of pay periods monthly quarterly etc. Ad Payroll So Easy You Can Set It Up Run It Yourself. Per the IRS S corp owners are required to pay themselves a reasonable salary as an employee of their company.

Taxes Paid Filed - 100 Guarantee. For example if your one-person S corporation makes 200000 in profit and a reasonable salary is 80000 you will pay 12240 153 of 80000 in FICA taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad The Best HR Payroll Partner For Medium and Small Businesses. The shareholders of a corporation may elect to be taxed.

Ad Process Payroll Faster Easier With ADP Payroll. How to calculate annual income. If your corporation pays you payroll of 10000 thats another 765.

But as an S corporation you would only owe self-employment tax on the 60000 in. Take a Guided Tour. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Calculate taxes and net payroll Like with payroll for standard employees S Corps must calculate and deduct the following from an employee owners wages. Get Started With ADP Payroll. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Paycors Tech Saves Time. Ad Process Payroll Faster Easier With ADP Payroll. The remaining 120000 is not.

Other considerations when choosing an entity LLC Limited Liability Company. This calculator helps you estimate your potential savings. Ad Payroll So Easy You Can Set It Up Run It Yourself.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Taxes Paid Filed - 100 Guarantee. 21020 Annual Self Employment tax as an S-Corp 19125 You Save.

The result is then used as. Being paid as an employee means that your wages are subject. Free Unbiased Reviews Top Picks.

Forming an S-corporation can help save taxes. We are not the biggest.

The Basics Of S Corporation Stock Basis

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate

S Corp Payroll Taxes Requirements How To Calculate More

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Vs Llc Everything You Need To Know

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Paycheck Calculator Take Home Pay Calculator

How Much Does A Small Business Pay In Taxes

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp